Are you a city or town that is considering offering middle and last mile rural municipal broadband connectivity? The need for ubiquitous fiber and wireless infrastructure is at a precipice. Moreover, the pandemic is now driving more people to rural communities and students into remote learning. If we do not act soon, some rural communities will get left behind and decline. While others with broadband will flourish.

Join Rio Blanco County’s Cody Crooks and Castle Rock Microwave’s Brett Bonomo at the Mountain Connect Broadband Development Conference. Hear about their success story on rural municipal broadband on October 26th at 2:30pm.

Brett and Cody reveal a model for rural broadband including:

First, Register here for the Mountain Connect Virtual Conference. And watch Brett and Cody’s presentation virtually. The theme for the conference is “Broadband: The Great Enabler for Disruptive Technologies!”. This year’s conference will explore:

1. The Impact of Emerging Technologies

2. Why Master Planning is Important to Long-term Success

3. Unique Funding Alternatives

4. Policy and Legislative Considerations

5. 5G/Small Cell

7. Economic Development

8. Impacts of RDOF and CARES Act

For more information on how Castle Rock Microwave helps municipalities with broadband solutions, please contact our sales team at 720 798-4520 or sales@castlerockmicrowave.com

If we have learned anything from this pandemic, it is that rural communities’ need better, faster broadband solutions now. Today, grants for broadband are being pumped into network expansion (fiber and fixed wireless) to satisfy the needs of online learning, work from home, and tele-medicine. Companies are switching to long term policies of remote workers. And corporations are shrinking headquarters office size for health safety and cost reductions. The defined broadband standard of 25/3Mbps is no longer adequate. We are already seeing large migrations of professionals from urban areas to rural communities. This trend should strengthen even more next spring. With that migration comes the demand for more electricity and higher broadband speeds.

Grants for broadband expansion are available for REAs to add broadband services to their portfolio. REAs have the infrastructure to do this more cost effectively than anyone else. Additionally, REAs will have a great opportunity to upgrade substations and radio systems with those same dollars for future video security, substation Wi-Fi, and IP migration. Control your own destiny. If you don’t, someone else will steal your virtual cheese.

Combinations of fiber and fixed wireless provide the greatest capabilities of cost effectively reaching customers in some of the most difficult areas. Bridging long expanses using microwave will help reduce CapEx costs.

Providing accurate information is critical for any grant applications and effective use of funds. Castle Rock Microwave can assist you with providing an accurate budget and designing a complete system from fiber to fixed wireless. Please contact Arn Hayden at (303) 358-7039 or sales@castlerockmicrowave.com.

In March of 2020 Colorado school districts were forced to offer alternative learning solutions to their remote students. This led to the prioritization of high-speed Internet access. Fiber isn’t everywhere. As a result, many remote students lack access to suitable Internet speeds. Without it, their distance learning coursework can’t be completed. This leaves many students and schools at a huge disadvantage.

Even though Douglas County School District had already begun distance learning, the reality is, not all students had sufficient Internet access to complete their work. That’s when a ranch owner contacted us. They needed our help. The ranch sits against the mountains near Highway 105. Due to the location, there are no terrestrial services available. In addition, cell coverage is inconsistent, providing only 3G speeds at best. Now more than ever, the workers’ children, students of Castle View and South Ridge Elementary, needed reliable high-speed Internet.

As Colorado’s premier wireless specialists, Castle Rock Microwave has a knack for problem-solving network connectivity challenges. We quickly identified a solution to deliver Internet to the ranch. Since wireless was the only option, we chose our strategic partner, Cambium Networks, as the equipment manufacturer. https://www.cambiumnetworks.com/

First, we transmitted an Internet connection from a tower in Castle Rock to Majestic Mountain using the ePMP Force 300 backhaul product. https://www.cambiumnetworks.com/products/epmp/force-300-25/

After that, we transmitted the signal down to the ranch, and from there and distributed Internet access to each home. To do this, we used the ePMP 3000L access point and Force 300 subscriber units. https://www.cambiumnetworks.com/products/epmp/epmp-3000l-fixed-wireless-access-point/

Then, we installed cnPilot r190 home routers inside the homes, making it easy for the students to connect online from any device. https://www.cambiumnetworks.com/products/wifi/cnpilot-r190-series-home-router/

With Internet speeds over 20Mbps, these remote students now have blazing fast Internet access whenever they need it. Everyone was thrilled with how inexpensive the solution was and how quickly it was installed. The students now have everything they need to complete their coursework, and then some. They can even video chat with their teachers and fellow students.

Because of our strategic alliance, we were confident in the ePMP, cnPilot, and cnMaestro solutions from Cambium Networks. This project was a huge success due to the efforts of Stevan Tewell, Rafael Candil, and Brett Bonomo.

Most companies can’t prevent outages. Castle Rock Microwave keeps your network connected so you stay online and never miss a mission-critical communication. If you have connectivity challenges and would like to schedule a free consultation, email sales@castlerockmicrowave.com or hit the contact button at https://rmmicrowave.wpengine.com/ today. One of our experts will be in touch almost immediately!

An industry test equipment manufacturer recently estimated up to 40% of all wireless microwave paths are not aligned optimally. We believe it’s more, perhaps as high as 60%, or higher. Of course, it’s a difficult assessment to make. However, we frequently troubleshoot installation issues and have observed thousands of deployments.

Optimal antenna alignment ensures the following:

1. Regulatory and frequency coordination compliance

2. Maximized system performance

3. Predictable system availability

There are several factors that impact proper antenna alignment. First, one must consider the appropriate antenna construction and installation. Secondly, the proper mounting hardware and installation. Next, the installer and weather are taken into account. Finally, the procedures and the equipment employed to perform alignment.

In our experience, the fewer parts required to perform field installation, the better. Occasionally, we have to install antennas we don’t like. In those circumstances, it is best to build the dish in a controlled environment before transporting it to the site. This is particularly helpful when a dish comes with a lot of small parts. Following this strategy minimizes potentially costly issues while on site.

The source of the alignment problem often stems from the mounting hardware. In many cases, it’s not appropriately sized for the dish or the pipe mast is not perfectly plumb. We have found that adjusting a dish through anything other than a single plane will result in completely unpredictable results. Installers forego perfect leveling of the pipe for a lot of reasons, but here are the most likely:

* Not properly educated on the importance of a perfectly level pipe

* Improper mechanical hardware to compensate for a tapered tower or uneven mounting surface

* The wrong tools and no level

* Fatigue

* Laziness

It should be obvious that mating the correct sized pipe clamps to the correct sized pipe is necessary. Unfortunately, we often see corners being cut as a way to save time and money.

The best way to ensure the dish mounting mechanism is installed properly is to require plenty of pictures. Doing so will remove any doubt that it was done incorrectly. Most importantly, pictures of a level placed on both axes of the pipe mast proves it is indeed perfectly level. This will help rule out any issues with the mounting hardware. In addition, you should include a photo with level on the back of the dish. This will show that the dish is level.

When proper alignment becomes difficult to achieve, and all other possibilities have been eliminated, it’s time to consider the installer. It can be physically and mentally grueling to spend hours on a tower performing the same procedure over and over, and not improving the situation. Nine times out of ten, the installer and their support people on the ground resign to the frustration and lack of discipline of proper alignment and just settle for low RSL.

I have witnessed proper alignment take multiple attempts by inexperienced people, until the “right person” arrives. Of course, the more experience someone has, the better they get at it. In fact, some installers can pre-align a dish with a high degree of success using simple navigation tools like a compass and nearby landmarks.

A favorite saying I’ve heard is that, “Plan B is not Plan A, with enthusiasm”. Sometimes it’s necessary to give the project a rest and come back to it, or put a new set of eyes and hands on it.

It’s very difficult to install relatively large dishes in the wind. Likewise, dishes that sustain exposure to high winds can move over time. It’s critical that appropriate tie-back hardware is used on larger antennas. Some customers require that 3′ dishes and larger have tie-back hardware. Often 6′ dishes have two tie-backs and 8′ dishes and larger have three tie-backs. The use of tie-back hardware (sometimes called “struts”) requires forethought and planning, to ensure that all of the correct hardware is purchased in advance.

In areas where propagation is more susceptible to inversions and weather-related phenomena (varying k-factor), it is very important to perform alignment during periods of stable weather. Generally speaking, ‘good’ propagation is accompanied by wind and sun, cold fronts can be good – once they pass, warm & stationary fronts are ‘bad’. I credit my friend and colleague, Tom Hendricks for this information.

Anticipate challenges in antenna alignment when shooting over or through reflective surfaces (ie large bodies of water or between many tall buildings or a narrow canyon). With a good design the results are predictable.

We often use the microwave radio to provide fine alignment of the system. Most radios provide an indication of Received Signal Level (RSL), sometimes called RSSI. One should always be aligning to a planned RSL (dBm) value, which is derived from path planning tools or software. In addition to providing an RSL value, some radios also give audible feedback with a buzz or beep, or visual feedback with LEDs. Regardless, we generally only use these aids for course alignment and rely on an RSL measurement for fine alignment.

On occasion, the antennas are being installed before the radios are available, so the radios cannot be used for fine antenna alignment. There are some popular products available for antenna alignment under these circumstances, like the Spectracom Path alignR.

Similarly, we recently witnessed a demonstration from a company called Sunsight Instruments and their alignment tool called the AAT-08. We found it to be a highly innovative tool and seemingly valuable in terms of expediting alignment, versatility and reporting capabilities. We’re anxious to get feedback from the field about how they work.

To reiterate, the right tools need to be used. This is typically ratcheting-style wrenches and socket sets of the correct size. In addition, a small torpedo level to ensure everything is perfectly plumb prior to alignment. We often see people using digital levels. These seem to work well. Your installer should also use a marker to put an indicator on the threaded rod. This will remind them how to get back to a certain signal level.

Prior to getting on the tower or building, a course alignment can be achieved using a simple magnetic compass, adjusted for proper angle of declination. Of course, this assumes that the path azimuth is known. Google Earth can help identify nearby and distant landmarks that the installer can use to aim the dish.

We always align the antennas with no up-tilt or down-tilt, unless the path is extremely short. This is the easiest way to begin alignment if the expected tilt adjustment is less than a couple of degrees.

Only one side of the path should be adjusted at a time. In addition, everything below assumes that both dishes are on the same polarization.

Once everything is level, the azimuth should be swept. You’ll often see one or more side lobes of the antenna before you see the main lobe. This is indicated by the RSL measurement. The main lobe is often distinguishable as having approximately 20dB more signal than the nearest side lobe. Likewise, it tends to rise and fall off very sharply, where side lobes can persist longer through a sweep cycle. Also, the main lobe is accompanied by the presence of at least two side lobes on either side of it.

If you were to start a sweep on the far left side of the radiation pattern of a dish, sweeping the dish to the left (pulling the left side of the dish towards them), you should see some amount of signal gradually increase and then decrease (one side lobe). Next, you will see the signal increase more than it did with the prior lobe and then decrease (another side lobe). Finally, the signal should increase significantly (~20dB) and quickly fall off. This is the main lobe. After this, the reverse of what was just described should be witnessed as the dish continues to be swept in the same direction, until the signal completely goes away.

Commonly, installers will only see a single lobe in the entire sweep. This is seldom the main lobe and evidenced by a signal level well below (10 – 20dB) the planned RSL. A lot of time is often spent aligning both sides of the link to keep landing on the lower-than-expected RSL. This is often due to one of the issues described above. Either mounting isn’t level, there’s tilt in the dish, or adjustments are being made on both side simultaneously, etc.

Another common symptom of poor alignment is that two rises and falls of signal will be seen, but well below the expected amount. This is just more evidence of either being above or below the main lobe, or not sweeping far enough through the entire radiation pattern.

Once the main lobes of both dishes are found, the elevation should be adjusted to optimize the link. Once both azimuth and elevation are fine tuned, the RSL should meet the planned signal level dictated by the path design.

There are definitely other things that can go wrong with microwave radio links. More often than not, the problems stem from a system that isn’t optimized. The most neglected step in optimization is proper alignment.

We’d love to hear your thoughts on the matter. Please take a moment and let us know how you deal with an installer or tower crew that swears the path is “on the main lobe”, when all of the evidence points to it being on a side lobe.

Don’t forget to click here and sign up to receive our latest blog posts and free content.

Years of attending and exhibiting at trade shows and vendor exhibits have revealed the four most common mistakes made by both attendees and vendors.

Trade shows are usually expensive to attend and can be a major distraction from your day to day activities if not managed properly.

Whether you’re an attendee hoping to learn something valuable or a vendor exhibiting at a trade show, every person should avoid these mistakes to ensure that your time and money are well spent.

You should have some idea of what you want to accomplish prior to registering. Almost every trade show I’ve attended has provided a complete schedule at least one month in advance of the event, often much sooner. This is your opportunity to pick a subject matter track or comb through the daily agenda and select the sessions you want to attend. I suggest attending a session in every available slot if it is a relatively short trade show (a few days or less).

Even if you struggle to find something relevant, sit through a session. You’re bound to learn something. If nothing strikes you during a session time slot, use that time to get caught up on emails, phone calls or assignments. Alternatively you should schedule a visit with a peer attendee or vendor. Don’t sit idle. Disengaging even a little bit can derail you from the rest of the event, so limit the amount of time you spend away and on your own.

Be present at the event.

It’s paramount that you plan at least two short breaks per day to follow up on missed phone calls and unanswered emails. You owe it to yourself, your customers and your organization.

Don’t simply rely on your out of office email auto-responder for the duration of the event and don’t use a trade show as an excuse not to respond to people, it’s unprofessional and a poor excuse. If anything, only use your out of office auto-responder to let people know that your response will be delayed, but give them some idea of how long it will take you to get back to them.

Your breaks shouldn’t be more than 20 minutes to at least get a pulse on what you’re missing back at the office.

If you generally maintain a hectic schedule, you might need an hour or more at the end of each day to cover the action items that you couldn’t accomplish from the exhibit hall floor or while in the sessions.

This is perhaps the most critical objective of any show or event – one on one time with specific suppliers, prospective customers or industry peers. Prior to the event you need to review the list of exhibitors or attendees planned for the event and identify the ones you must see.

Plan intentional visits, by time and location.

I’ve found that during show hours is a tough time to get commitments from people since there is so much happening. Meal times are a great opportunity to lock someone into a meeting. Get in touch with them in advance of the show. If you’re uncertain about how to do this, ask us. We’ll give you some pointers.

A great trade show pre-plan can be completely foiled by a big night out on the town. It inevitably happens. A customer or vendor keeps you out too late, buys too many drinks, you indulge too much, etc.

Commit yourself to a reasonably healthy schedule.

Take advantage of an evening meal or outing to build relationships, but don’t over do it. There’s too much at stake in terms of the cost of the show and missed opportunity to sit down with a lot of vendors or customers in a single location.

There are certainly other mistakes you can make at or in preparation for a trade show. Bring comfortable shoes, pack a light jacket as the rooms are often cool, pre-plan transportation between your hotel and the event and bring plenty of business cards.

Maybe you’re not one to necessarily socialize with strangers, but be intentional about taking advantage of the networking events. For some this is just good practice.

Don’t think of trade shows as a boondoggle or an opportunity to miss a few days of work. That’s a waste of your time. Make the most of the opportunities to cover a lot of ground with people that are relevant to your business and often, your success.

Have some specific objectives in terms of things you want to learn, people you want to speak with and information you want to collect.

Once back to the office put those collected business cards and data sheets in a safe place and drop a quick email to each person you met to ensure you have a way to keep track of them.

The things mentioned above have allowed me great success and relationship building at trade shows.

Please take a second and let me know below if you have a specific method for trade show success.

Don’t forget to click here and sign up to receive our latest blog posts or free content.

Defining your “WHY” will transform the way you conduct your business and manage personal relationships.

How often do you ask yourself “WHY”? We highly recommend you take the time to watch Simon Sinek’s 18-minute TED talk: How Great Leaders Inspire Action. His presentation is based on his award winning book Start With Why – How Great Leaders Inspire Everyone to Take Action.

At Castle Rock Microwave, this video transformed the way we think about our people and our business. In addition, we believe it has had a positive impact on our personal lives. After all, our role as leaders is limited by how well we lead ourselves.

As business leaders and entrepreneurs we generally lead with WHAT we do, and sometimes HOW we do it, instead of the WHY that truly drives us. For example, if you are in the business of selling microwave radios you probably start most customer visits by stating the capabilities of the product, sharing data sheets to highlight the features and express the company’s relevant expertise. These define the WHAT. From there, many go on to cite examples of impressive projects to prove the quality, workmanship and reliability (the HOW).

In his talk, Sinek posits that customers don’t buy WHAT you do or HOW you do it. In reality, they buy WHY you do what you do. Your WHY, when properly communicated, has the power to inspire people to take action. Think about that for a second.

I remember taking a job in a highly competitive market. This was for a company no one had ever heard of. They didn’t even have a single product yet. However, they set out with the audacious goal of not only challenging the status quo in its industry, but leading the industry through innovation, creativity, and experience. We were certain that we would take the market by storm, and we did! If the recruiter had simply sent me a few data sheets of prospective products and bios of the executive team members, I probably would have never accepted that interview. As it happened, I bought into their WHY and I was inspired!

The WHY has to resonate with your employees, partners, followers and potential customers. There’s a fine line between inspiring people, and manipulating them. Inspired people become loyal, and loyal people are willing to follow you at the cost of a higher price, inferior feature set and popularity. On the contrary, appealing to someone through a trade, discount, special offer, or expected kick-back in the future is a manipulation.

Manipulation in the business sense isn’t necessarily inappropriate. It’s imperative, however, to be able to recognize the difference between truly inspiring someone and getting someone to take action on the basis of getting something in return. The downside of the latter is that these people will continue to expect the same deal each time. Likewise, exchanges that occur as the result of a manipulation don’t foster loyalty and tend to be very transactional. People want to be inspired. The greatest bond will be with people that buy into your WHY.

We’re convinced that people buy the WHY, not the WHAT or HOW, and the WHY has the power to inspire people to take action. A clearly defined WHY creates a powerful filter we can use to make good decisions.

A clearly stated WHY solidifies our cause and our core conviction in business and personal relationships. In the face of difficult, important decisions the WHY can move the needle on determining the best course of action. It will also enable more reliable decision making when the pressure is on and stress is high. The WHY should create a sense of accountability and discipline to ensure that we stay committed to it.

If you’re a business owner or you lead an organization, think about what gets you out of bed each morning. The thing that gets you fired up about what you do. My guess is that it’s not just to make money. If you’re like me, it has to do with relationships and experiences. It’s also a desire to delight people and solve problems. Perhaps you enjoy empowering people to provide for their families or you sincerely want to enrich lives through technology.

Before you move on to the next thing you do, ponder your WHY and write a quick comment to share it with us. If you haven’t thought much about this in a while, the few minutes you spend to think about this might be one of the best investments of time you ever make. And sharing your perspective can inspire others too!

Also, don’t forget to sign up for notification of future posts. Click here

Castle Rock Microwave is constantly evaluating different tools, software apps, pieces of test equipment and methods. We do this to help streamline our broadband wireless deployment and maintenance obligations. Everyone loves the allure of new toys, but few have unlimited budgets. One could easily overspend in these areas. This post should help you identify the 5 best tools for the broadband wireless technician. In addition, it should identify the right time to invest in each.

Everyone deserves the right tools at the right time. This helps you be the most effective in your job. It also ensures a successful outcome. At minimum, there is a list of necessary, non-negotiable hand tools that everyone needs. First, a full compliment of screwdrivers. You need big and small, flat and Phillips. Also, Allen wrenches, combination crescent/box wrenches and socket sets. Additionally, a full set of ratcheting wrenches. Don’t forget portable power tools, tape measure, torpedo level, lug crimpers, wire strippers, and side cutters. You’ll also need needle nose pliers, a simple CAT5e / CAT6 continuity tester, digital voltmeter, and a good compass with inclinometer. Finally, you should always include binoculars and a digital camera.

This list isn’t exhaustive. Your first installation usually dictates which tools you need the most. In addition, it’s critical to have manufacturer-recommended coax stripping and termination tools. We keep tools on hand for LMR-400 and LMR-600 as well as 1/2″ Heliax. These are the three most popular types of coax for our deployments. We also use manufacturer-recommended CAT5e and CAT6 termination tools. While these may be pricier than alternatives, they are specifically intended for the type of connectors we use from Sentinel Connector Systems.

We discourage the use of utility tools like knives, adjustable wrenches, vise grips, most pliers and striking tools. These items are rarely necessary and often cause damage. Use the right tool for the job, every time.

Broadband wireless radios have become more sophisticated. As such, one might think fewer pieces of test equipment are necessary. Some newer products have built-in spectrum analyzers. There are even a small number of radios with built-in bi-directional couplers and VSWR measurement capabilities.

However, if you’re like us and support a wide variety of radio products, it’s hard to count on having everything you’ll need built into the radio. As a result, we believe you need the following pieces of test equipment, listed by importance:

* Broadband power meter

* Cable and antenna analyzer

* Spectrum analyzer

* Ethernet throughput testing device

* TDM bit error rate tester

We’re a huge fan of the Praxsym t-meter. It’s an inexpensive device to measure the transmit power of a radio, test coax connections, indicate VSWR of the transmission line, and validate the integrity of an antenna. This recently paid for itself while troubleshooting a licensed-band 6GHz radio system. It would have been nearly impossible to isolate the bad radio without this device. The radios would not link up and we couldn’t tell which radio had a bad transmitter or a bad receiver. Within minutes we connected the Praxsym t-meter PM-6000 to each radio in order to identify the radio with a bad transmitter. This tool will save hours and days of time on long wireless paths.

We’re a huge fan of the Praxsym t-meter. It’s an inexpensive device to measure the transmit power of a radio, test coax connections, indicate VSWR of the transmission line, and validate the integrity of an antenna. This recently paid for itself while troubleshooting a licensed-band 6GHz radio system. It would have been nearly impossible to isolate the bad radio without this device. The radios would not link up and we couldn’t tell which radio had a bad transmitter or a bad receiver. Within minutes we connected the Praxsym t-meter PM-6000 to each radio in order to identify the radio with a bad transmitter. This tool will save hours and days of time on long wireless paths.

Many wireless carriers, utility companies, public safety agencies, and high frequency trading firms require line sweeping on transmission line installed in their systems. There are a handful of options available. Some include Anritsu, Bird, Agilent, Keysight, and Kaelus. However, the field narrows as frequency increases above 6GHz. Cable and antenna sweeping is critical to establish a performance baseline at deployment. Doing this helps identify problems over time. It also validates the quality of an installation. We purchase the VNAMaster MS2038C from Anritsu. It is a cable and antenna analyzer with a built-in spectrum analyzer that goes up to 20GHz.

Many radios now come with built-in spectrum analyzers. While this is handy, sometimes a separate, portable device is still required. A stand-alone spectrum analyzer is very helpful in detecting interference. You can use it from the ground to verify a deployed radio is transmitting. We have used portable devices from HP, Anritsu and others. We own an Avcom spectrum analyzer for the license-exempt frequency bands. We also recently invested in a more full-featured unit that allows us to pursue projects below the microwave radio band. Such bands support in-building wireless like BDAs, DAS, LMR, etc. Finally, there’s a new family of spectrum analyzer products from SAF Tehnika. We believe these will address the needs of most broadband wireless technicians and field engineers for microwave bands. A noteworthy nugget regarding the SAF Tehnika spectrum analyzers is that they can be purchased in segments of frequencies bands, making the cost of entry very attractive.

Most of the microwave work done today involves Ethernet transport. Many end users want proof of the quality of their wireless system. They usually want this in terms of maximum Ethernet capacity and latency. There are many inexpensive ways to do this. You could use a pair of PCs, but they are generally not very accurate or conclusive. Many customers require RFC2544 test results. This stresses the system at various frame sizes and speeds to find the performance limitations of the wireless system. Valuable information about latency and jitter can also be obtained with this kind of equipment. There are many sources available. We have the most experience with JDSU (Viavi). We have also seen NIDs (Network Interface Devices) as a less expensive alternative to a hand held test device. These small form factor computers with a web-based interface can be used to run similar tests as the equipment described above. This equipment is usually helpful in pairs. One device on each end. One such manufacturer of this type of equipment is Accedian.

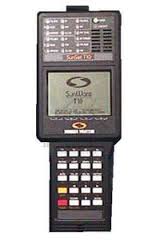

The oldest piece of equipment in our cache is definitely not the least valuable. It’s a rare occasion that we install radios with T-1 interfaces. However, when we do, it’s quite helpful having the right equipment on hand to verify that T-1 traffic is properly transmitting. Often, the customer’s telecom equipment will provide this assurance. Yet, dedicated test equipment is a consistent mechanism to validate operation. We use an older piece of test equipment from Sunrise Telecom known as the Sunset T1 tester. These are fairly plentiful and inexpensive on eBay.

In addition to the hand tools and test equipment described above, we maintain a kit of waveguide to coax transitions for 6, 11, 18 and 23GHz. We also keep short precision coax cables and attenuators to bench test radios before deployment and aid in the troubleshooting process. We also sell these kits to folks that want to have them on hand.

There are other tools we keep handy. First on our “nice to have” list is a laser ranger finder like the TruPulse 360B for measuring structure and antenna heights. Then, an earth ground tester from Fluke or Megger which measures ground loop resistivity and ground rod testing. Additionally, we’d want a GPS-enabled high-resolution camera. While a mobile phone can provide geo-tagged photos, a high-resolution camera provides crisp detail on a radio or antenna hundreds of feet above the ground. Finally, we hope some day to get to play with some of the antenna alignment tools from Spectracom, Sunsight or 3Z Telecom.

The tools described above are a necessity and non-negotiable in terms of timing. You minimally have to have these tools to successfully deploy and maintain a broadband wireless system.

At the very least, we recommend a Praxsym t-meter, or comparable device. It is relatively inexpensive and can save a tremendous amount of time in troubleshooting systems 6GHz and below.

Depending on the types of radios you install and support most often, some other pieces of test equipment are more critical than others. Generally speaking, test equipment should be purchased as it can be afforded. A great way to accelerate your time to purchase is to find a reliable source for used equipment.

We generally wouldn’t buy any equipment until we’ve identified a time when our rental costs would approach or exceed the cost to buy the equipment new.

The inability to afford test equipment isn’t an excuse not to have it when needed. Test equipment in each of the categories above can be rented on a short term basis which is an excellent way to overcome the issue of cost.

Do you have a tool or piece of test equipment that you simply cannot live without? Share it here, please!

It's easy to fall into the trap of believing that we're alone in having a certain problem, need or deficiency. You're not alone!

This summer we surveyed hundreds of broadband wireless professionals in an effort to understand some of the largest gaps and pain points in the industry.

The professionals surveyed included end users in the public safety, energy, utility, broadcast, telecom and cellular sectors. As well as an equal number of equipment resellers and distributors.

The end users received a different survey than the sales channel folks, but with several overlapping questions. The results below represent the percentage of people asked a particular question. The purpose was to identify the greatest common pain points and gaps across all industry professionals. Obviously, some items are not relevant to all respondents

Without further ado, here are the results!

The following observations and points reflect some additional details that were collected, but aren't necessarily represented above:

* Equipment resellers and distributors were the most responsive to the survey

* Wireless professionals generally want more freedom from their desks and traditional computing devices

* They also want to streamline and automate the design and deployment processes in the field

* Tools that are available today are too expensive or don't offer adequate value

* As simple and necessary as network monitoring is, it is often not implemented

* People in our industry are overwhelmed by the variety of wireless solutions available

* Formal training for broadband wireless is sparse

* Few sales professionals in this industry embrace customer relationship management (CRM) tools and automation techniques to help stay in touch with their customers

I wish we could create dialog with everyone that reads this post to see if these items resonate, and perhaps identify other gaps.

Castle Rock Microwave is working to solve many of these problems for ourselves and our customers. Some solutions we have are through partnerships and others through innovation and invention of our own. We want to help make your life easier!

Do these pain points and gaps resonate? I’d love to hear from you! Please leave a comment below.

Also, don’t forget to sign up for notifications of new posts! Click here

By Brett Bonomo

Quitting doesn’t come easily for me. In the past year or so I quit my job, quit some bad habits, quit being so grumpy, quit saying “no” to fun invitations from dear friends and quit being away from my family.

Truthfully, the most significant seemed to be quitting my job, but the rest were welcome results.

I was deeply passionate about my job, the company I worked for and the people that I worked alongside. As a key contributor within the organization, I believe I gave my best and had a positive impact there. It was the eight most significant years of my career in terms of personal and professional growth.

But, it was time to move on and pursue a lifelong desire to create and grow my own company.

The decision to quit, for most people, is really difficult. These are the questions that haunted me:

• How will I know when it’s finally time?

• How do I quit with dignity and respect?

• How do I plan it?

• How exactly will that conversation go?

Note - If you’ve had five jobs or more in the past five years, chances are that you struggle to take jobs well or quit jobs well. This should not be a vicious cycle. The good news - there's always time to make improvements.

Quitting should never be an emotional reaction

I gained clarity in deciding to resign from my job when I realized I could no longer affect change and I started to realize that I was likely going to become a problem rather than a problem solver. My ability to be a constructive participant and thought leader had diminished. This was deeply personal for me and a tough realization. Often there are ways to rise above situations like this and overcome whatever circumstances exist to continue to be productive. I was simply wore out. Believe me, there were times that emotionally I wanted to check out, but I refused to leave on a bad note.

You should avoid quitting in the middle of a major project (if you’re a key contributor) or at the end of an important sales milestone (month, quarter or year). This was wise counsel I was given and I’m glad I took it. If you’re a valuable part of an organization, there’s never a good time to quit. Be thoughtful about the best time relative to your position.

I had a lot of great, personal friends, really almost family, at this company. My boss at the time had only been there a short time, but I owed it to him and myself to follow the chain of command rather than calling all of my buddies first or going directly to the CEO and COO, who I knew very well. At least one dear friend was really upset that I didn’t come to them sooner, but I slept well knowing that I did the right thing. It’s hard to anticipate and manage all of the collateral damage. All you can do is hope that people will understand and not take your departure personally.

The conversation with your boss should be an honest one. It shouldn’t be highly emotional or a time to reflect on all of the factors that contributed to your decision. It is not the time to point out all of your supervisor’s or company’s faults. Just to be clear, I was quite satisfied with who I was working for just before I quit, which made the decision that much more difficult. You should concisely state that you have decided to resign. Give your employer plenty of time to plan and implement a transition. I believe it is appropriate to say where you have accepted your next job, if you have signed an offer.

The ultimate outcome of how well you quit will absolutely reflect your integrity and credibility. You do not want to be perceived as a guy that was working two jobs at the same time. Whenever possible, try to build a break in between your end date and new start date. This is important for a couple of reasons. First, a break to clear your head is hugely beneficial. Second, it lessens the likelihood that you spent the majority of your time hunting for a new job instead of working. I had planned for a four month sabbatical, of sorts, between the end of my most recent job and the start of my new company.

Finally, you always have to anticipate a counter offer, if you’re a valued contributor. I don’t believe in counter offers. If you’ve gotten this far in the quitting process you should be 100% committed to your decision. People that accept counter offers are seldom all-in. There are probably only a couple of reasons when and why one would accept a counter offer. An employee worth having and an employer worth working for will be reasonable about any inequity in your current arrangement, financially or otherwise. Don’t threaten to quit in order to get something you want.

These steps helped me wind down a successful eight-year employment. I am still in touch with the top leaders of the company and will continue to do business with them. It’s a process that took at least three months from the point I decided that my resignation was imminent to the day I handed in my PC.

Have you gone through this recently? If you'd be so brave, what would you have done differently in hindsight? Please, drop me a quick note in the comments section.

Last year we were performing a major microwave backhaul upgrade for a customer. We were working to cut over the last of several hops of high capacity (~1Gbps) radio links. This hop was the most critical in that it was the main path to half of their network, with no backup. The site we were at was the least accessible, the weather was bad and we didn’t believe we’d get back to it until the next spring season after this visit. I had three guys freezing on the tower and everyone was anxious to make the cut, button things up and get off the mountain. We were doing the work on a Tuesday, one of the most sensitive days of each week for this customer’s business data. To make things even more complicated, cellular coverage on the mountain was really poor, so communicating with the folks at the other end of the link was frustrating at best.

An outage for our customer of any noticeable length was out of the question. The pressure was palpable and coming from many directions. The customer’s employee in charge (EIC) was at the opposite end of the link with one of our guys awaiting our call and next steps.

We were within minutes of being ready to cut traffic over to the new link and the EIC indicated that we would have to delay the cutover as he was being pulled another direction. Given the circumstances we had on the mountain top I pushed hard, beyond my customer’s comfort level, and pressed the matter. He reluctantly gave me the green light to proceed and we made the cut. The transition to the new radios was without incident. Data was moving well, so the EIC went about his other business and left us to start to wrap things up at the sites.

In the process of finishing up I thought I’d make one more configuration change in the radios that would prepare us for the next step of the system upgrade a few days later, to take this 1+0 system to 2+0 (utilizing XPIC). The configuration parameter I was about to change would simplify the turn-up of the second set of radios on the same dish, at a later date. I felt like I knew the radios well enough to predict that the configuration change I was about to make would not have an impact on existing traffic. I was dead wrong.

Fifteen minutes after I made the last configuration change I received a call from a hot EIC. Half of their system had been down that long. It was not a good day for me.

I learned what I call some “life lessons” on the mountain that day. This is what we do differently now:

It pains me to even think about what happened that day, but on the flip side it caused us to institute structure that will help prevent an issue like this again. In this case, the customer was gracious and after a long conversation the next day our partnership grew stronger.

If you have it in you, let me know below if you’ve ever been in this spot.

Don’t forget to sign up to receive updates to our blog here or in the tool bar on the right.

"We guarantee your system will work as designed for the first year, or we'll make it right."

Please CLICK HERE to read our full Terms & Conditions